Since it’s still January, we’re right in the thick of Metrics Season. Traditionally this is the season where we measure everything, take a look at our upcoming year, and then decide to measure everything we measured last year and also add a few more. While today we’re talking about supply chain metrics, I’m also telling you to STOP.

Take a pause. If you had to pick only three metrics to measure, what would they be?

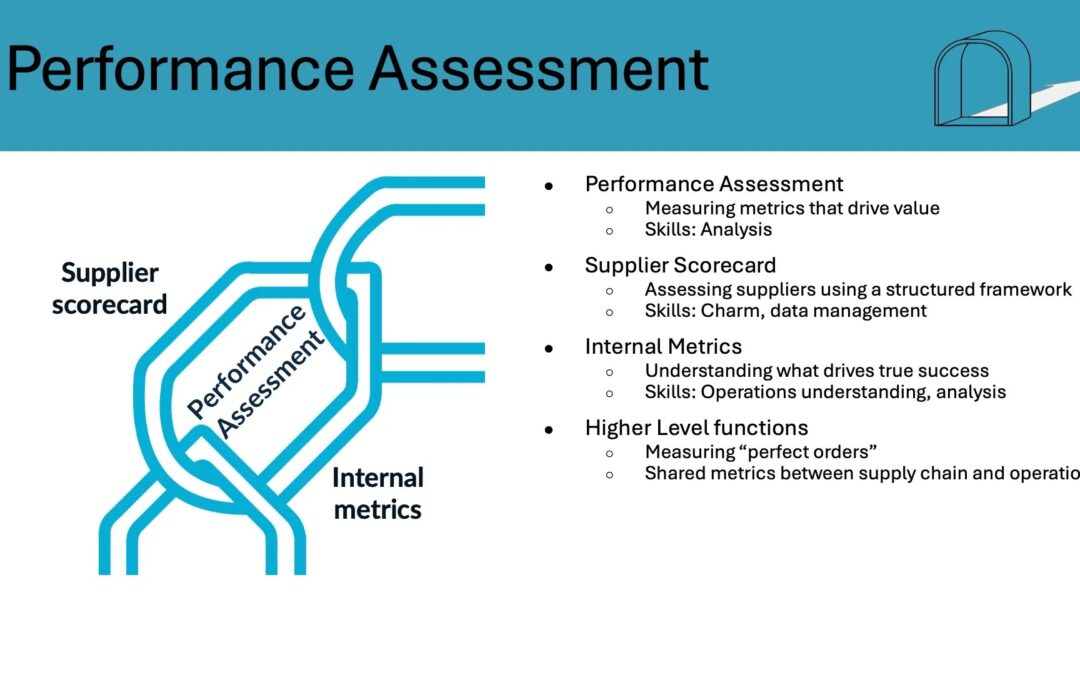

Metrics are part of the Performance Assessment link in the supply chain cycle, measuring the performance of both the internal and external supply chain before starting the cycle anew. It’s incredibly common during my Supply Chain 360 reviews to ask the supply chain team: “What metrics do you track?” and get as many different answers as there are team members. I’ve only had one client where everyone on the team listed the same three metrics in answer to that question. So what is a supply chain leader to do? We think we have our team gathered up, driving in the same direction, but chances are good your metrics lack focus. Let’s dive a little deeper into the Performance Assessment link, internal and external, so you can make good decisions and track metrics that matter.

Supplier Scorecards

The supplier scorecard is your external-facing metric. Its purpose is to:

- Frame the conversation with your key suppliers, whether you meet weekly, monthly, quarterly, or annually.

- Provide an opportunity for two-way feedback. A supplier scorecard should never be a lecture one way or the other.

- Structure the frequency of conversations with suppliers. If it feels extremely redundant to have the same conversation with suppliers about their scorecard every meeting, you’re probably meeting with that supplier too frequently or their scorecard isn’t measuring the right metrics.

- Reinforce your company values with your suppliers. I always like to take the company values and frame up supplier scorecards around those values to reinforce the company culture with both the supply chain team and the suppliers.

- Document the relationship with your suppliers. Your scorecard is your tracker for supplier performance (and your performance as a customer too!) and can help serve as the documentation of the relationship. It adds both clarity and history to the paper trail that outlines your supplier relationship.

When building a scorecard, ask yourself these questions:

- What are our company values, and how do our suppliers support those values? For example, if Sustainability is one of your company values, do you measure your supplier emissions? Or green certifications such as ISO 14001? See if you can fit your supplier metrics into your company values. If you have a metric that doesn’t seem to match any of your company values, ask whether it’s something that makes sense to measure.

- Which suppliers get scorecards? Not every one of your suppliers should have a scorecard. They are a lot of work to put together, review with suppliers, and use to build a relationship. I’ve also seen many supplier scorecard programs fail when a company tries to roll them out to every key supplier at once. Start with maybe one or two suppliers per category manager only, then consider rolling out to more. This might mean only a half dozen suppliers get scorecards to start, which is plenty.

- How will we maintain relationships with suppliers? Don’t let a supplier scorecard program become a way to “beat up on” or otherwise bully your existing suppliers. Be transparent about why you’re rolling out a program, how it aligns with your goals and theirs, and how you’re going to use it to be a better customer in their portfolio.

- How will we allow supplier feedback? Because a successful supplier scorecard program is a two way street, how will you enable your suppliers to offer feedback? One of the most overlooked aspects to buyer power in a traditional Kraljic Matrix is how easy a company is to have as a customer. You want suppliers who are easy to work with, but you also can gain a lot from suppliers if you are an easy customer. Supplier feedback channels make it easier for suppliers to tell you where their pain points are and serve you better (Are you paying invoices on time? Are your orders clear and easy for them to know what you send you?).

Internal Metrics

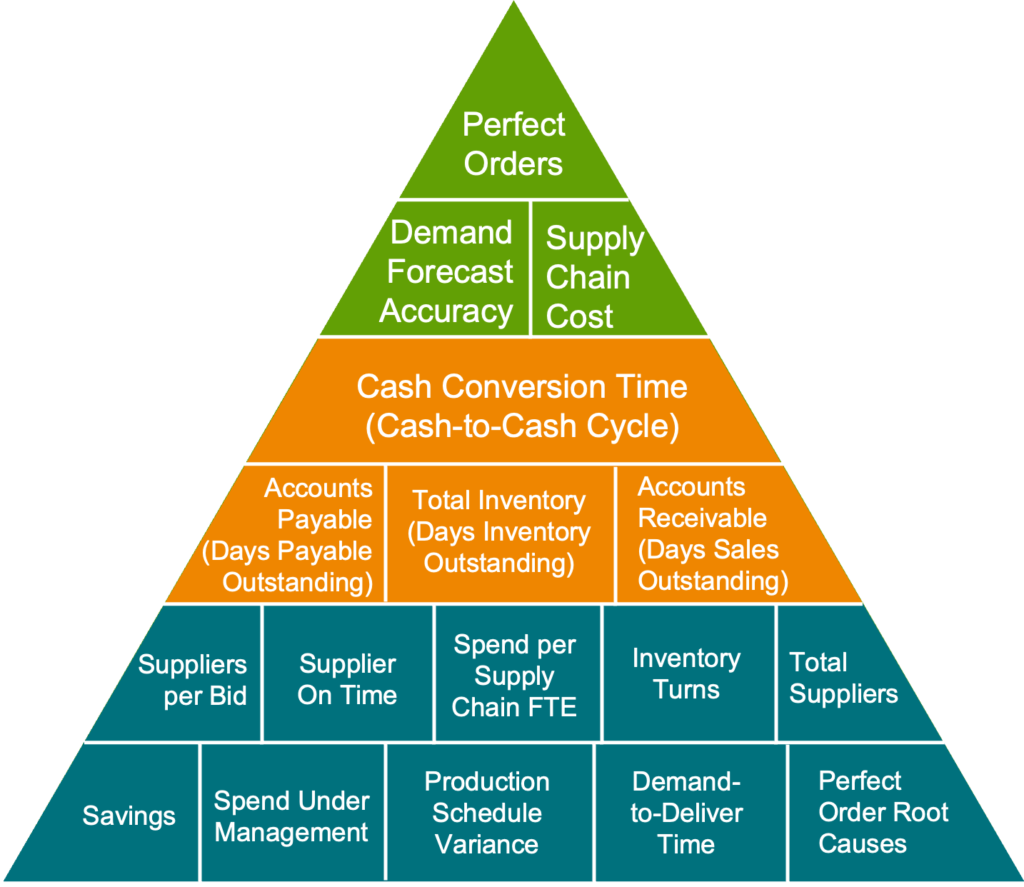

The below pyramid has many variations and iterations.

It is derived from a metric pyramid created by Gartner, but edited slightly for a small manufacturing client of mine. Lora Cecere, Supply Chain Shaman and all-around sharp researcher has her own variation. My version puts “Perfect Orders” at the top because I think that if your order is perfect, it means all other metrics fell into line. I wrote an article about what goes into a perfect order in March of 2024. Ultimately, each organization has to decide which metrics are truly important for themselves. Don’t fall into the trap of trying to measure all of these things and consider them “equally important.” Questions to ask when setting up your internal supply chain metrics:

- What is the Operations team measuring? While this may seem like a funny place to start, it’s an important one. Ultimately the supply chain team is there to support the operations team and get the completed product or service to the end customer. As much as possible, consider making the supply chain metrics and measures of success directly echo those of the operations team.

- What problems do our metrics need to solve or improve? “That which is measured improves. That which is measured and reported improves exponentially” – Karl Pearson. Metrics without a problem to solve or a performance to improve are busywork. Don’t relegate your analyst team to busywork; know what organizational problems you are trying to solve and how improving your metric means those issues are improving. Then make sure your team understands the why of what you are measuring.

- What components make a perfect order? If you’re going to use perfect orders as one of your key metrics, how do you define a perfect order? If you use this metric correctly, it can actually measure multiple things, such as how robust your process is or how many orders are delivered on time and in full (OTIF). It can also drive accounting behaviors such as paying suppliers on time and electronically instead of by paper check. Note that the perfect order metric is likely to be very low when you start measuring it, probably less than 10%. Don’t let that deter you from defining “perfection” as it should be.

- How do we fold in current metrics? Chances are very good you’re measuring something right now. Don’t necessarily throw that out, but do take a careful look at it and ask if it’s the right set of metrics. Does your team understand the metrics you’re measuring? Do they use them? Do they understand why the metrics are important? Can they name those metrics without a cheat sheet? Don’t necessarily start over from scratch, edit what you’re already doing to serve you better.

- How do we incorporate scorecard metrics? If you’re measuring On Time in Full for your suppliers, perhaps it’s a key metric to track beyond just those suppliers with scorecards. Or perhaps it’s part of a larger metric. Either way, the supplier scorecard and internal metrics should not each stand in their own bubble. They should be related to one another and to the company values.

- What are our top 3 metrics? When someone randomly asks any member of the team “What metrics are you measuring?”, what three metrics should they immediately spit out as the answer? There are hundreds of things to measure in a supply chain, but the direction of the department should echo through every team member at every level. Spend lots of time focusing on what matters and let the rest go.

So what is on your list this year? Does everyone know what they’re supposed to be driving toward for metrics? Do your suppliers understand what matters most to you? If you’d like to talk through your metrics or arrange for someone to facilitate a deep dive into metrics that matter, let’s chat.