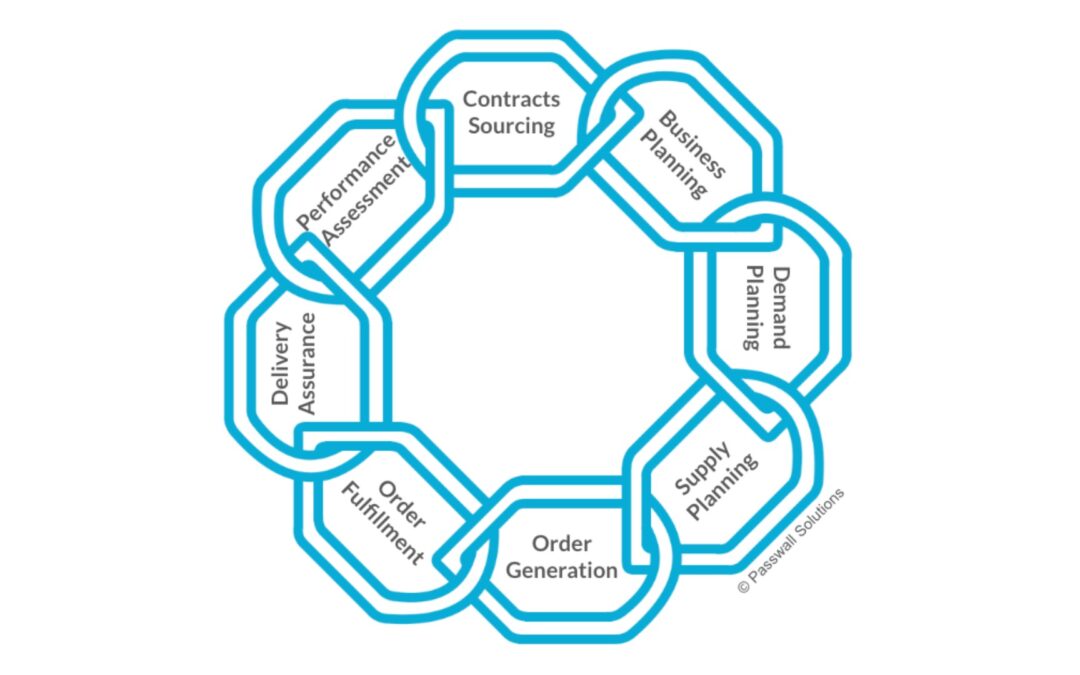

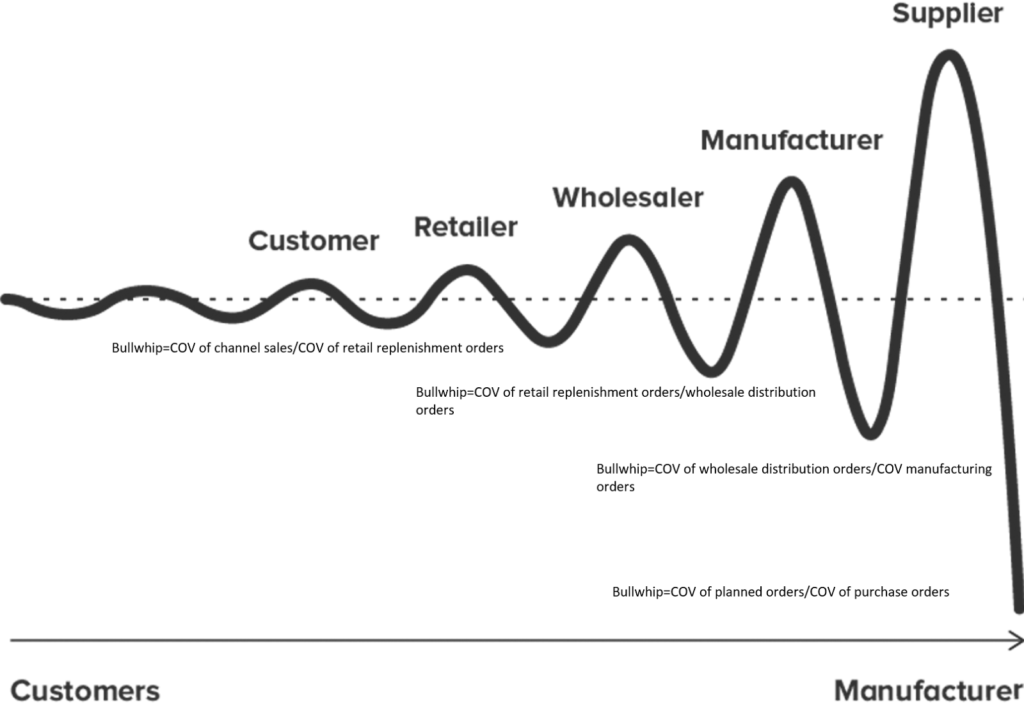

In this segment of our comprehensive series exploring the entire supply chain cycle, we delve into the central aspect of the planning function: demand and supply planning. In larger or more mature supply chain teams, these planning functions often form integral parts of core supply chain responsibilities. Conversely, in less integrated teams or certain organizations, these functions may fall under operations. Companies lacking planning functions often find themselves oscillating between excess inventory and severe shortages, as the absence of planning reverberates throughout the supply chain. Lora Cecere of Supply Chain Insights provides an insightful graphic illustrating this effect.

Demand Planning

Demand planning, a crucial phase in the supply chain cycle, is dedicated to predicting a company’s “pull” on its suppliers. As we progress through the cycle, approaching the point where a company’s needs intersect with those of its suppliers, demand planning becomes pivotal in determining the quantity required from suppliers. The primary components of demand planning include forecasting and commodity index analysis.

Forecasting

As highlighted in the initial article of this series, every link in the chain has both internal and external dimensions. The internal facet of demand planning revolves around forecasting. Numerous tools assist planning professionals in forecasting demand, with the key being the selection of a tool that people comprehend and can effectively use. At its essence, forecasting involves determining the required quantity of a part within its lead time, incorporating a safety stock, and adjusting for the order quantity. The complexity arises when usage is irregular due to factors such as seasonality or production ramp-up. Here, the Supply Chain Insights graph becomes crucial, emphasizing the role of communication in preventing an exponential effect. Supply chain success hinges on relationships, including those with sales and manufacturing teams that can effectively communicate upcoming demand cycles.

Commodity Index Analysis

The external facet of demand planning entails analyzing commodity indices to identify market trends. A previous article on data-driven negotiation discusses relevant commodity indices and offers guidelines on using the Bureau of Labor Statistics indices. Companies dealing with cross-border material purchases should monitor currency exchange rates along with key commodities. This monitoring serves two primary purposes: understanding trends in external customer and supplier behavior, and helping supply chain professionals decide when to bid, contract, or hedge commodities. When driving value by bidding a particular category, timing is everything.

Supply Planning

The supply planning link in the supply chain cycle focuses on responding to a company’s “pull” on its suppliers. The primary components of supply planning include aggregations and supplier demand planning (or production planning).

Aggregations

The internal component of supply planning involves aggregating spend to enhance market leverage. Companies often exist within larger circles, be it through ownership by a holding company, membership in a conglomerate, participation in a buying consortium, or association with a chamber of commerce. Businesses purchase common categories such as travel, office supplies, and employee benefits. Successfully navigating this challenge comes down to relationships, determining how well companies can aggregate spend and bring added value to shared purchases. On average, a 4% savings results from aggregating common materials, fostering collaboration that also yields improved scopes of work and intangible benefits. It is a tricky road to travel to get different businesses to work together, but when successful the value is huge.

Supplier Demand Planning

Externally, supply planning entails communicating forecasts to suppliers. Transparent and extensive communication is crucial, relying on a high level of trust from both parties. Suppliers must grasp the certainty level in a forecast, while companies should minimize unnecessary changes to the forecast. Flexibility is essential, but both parties must make a good faith effort to use the forecast to mitigate risk and cost. Effective communication and supplier demand planning lead to successful supplier production, representing the external component of the order generation supply chain cycle link.

The subsequent article in our series will spotlight the two components that most supply chains excel at: order generation and order fulfillment. We’ll delve into logistics and purchase orders, along with supplier production planning, forming the core of the purchasing function.