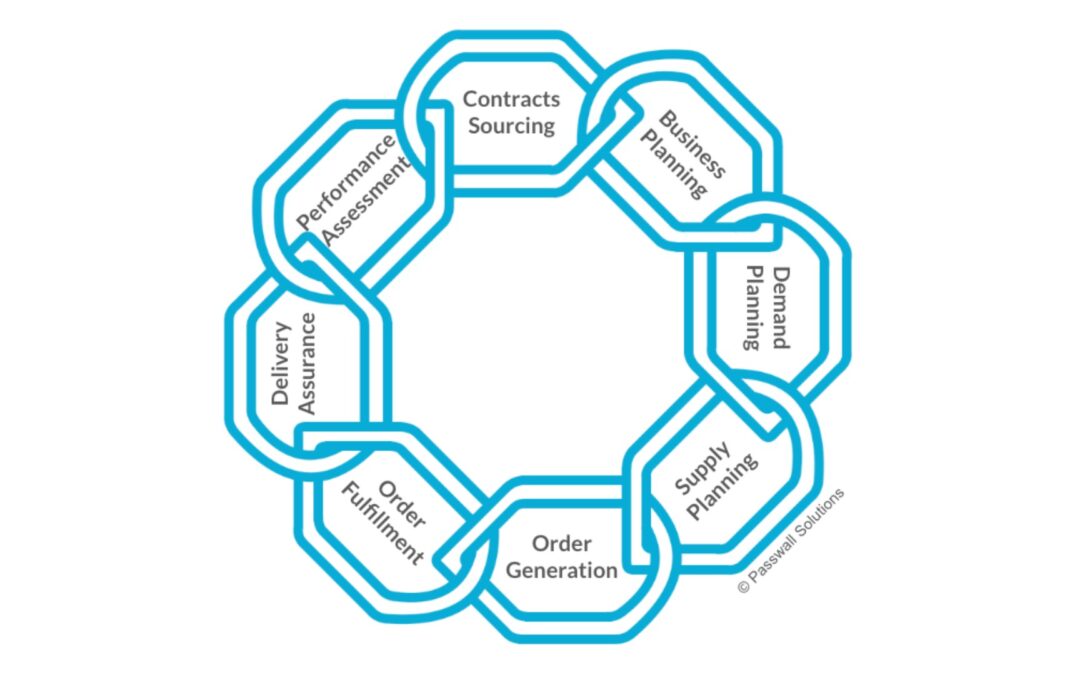

Embarking on the first installment of our comprehensive series delving into the intricacies of the full supply chain cycle, we kick off by exploring the critical junctures of contracts, sourcing, and business planning. While we could start anywhere in this cycle, let’s start from the top. Within this model, eight main components encapsulate major processes or steps, each with both internal and external facets. Today’s focus centers on the “Contracts and Sourcing” and “Business Planning” links in the supply chain.

Contracts and Sourcing: Clarifying and Mitigating Risk

The contracts and sourcing phase plays a pivotal role in the supply chain, encompassing requests for proposal (RFP), requests for quote (RFQ), requests for information (RFI), contract negotiations, supplier management, and supplier development. Primarily, this link aims to bring clarity to the entire supply chain cycle, mitigating risk and setting the rest of the cycle up for success.

Supplier Management: Safeguarding Internal Operations

Internally, supplier management tackles risk associated with existing suppliers. Long-term contracts, spanning 3-5 years, define terms beyond purchase order terms and conditions, covering aspects like incoterms, warranties, and cybersecurity. Well-crafted contracts offer clarity on risk allocation, paving the way for informed negotiations and preventing pricing complications or double padding arising from uncertainty.

Another consideration under supplier management is what percentage of spend is under written contract. The percentage of spend under contract is different from percentage of spend under procurement jurisdiction as the spend under contract is “fully completed” through the full supply chain cycle, whereas any other spend under procurement control is simply somewhere in the process.

Additionally, the enterprise resource planning (ERP) system, typically leveraging platforms like SAP and Oracle, plays a crucial role. While a well-run ERP system enhances overall supply chain management, complexities often arise due to outdated implementations. There is no easy fix for this, but starting with determining “what good looks like” is critical – what does the supply chain world look like if the ERP system is running to its best ability? Then: what gaps can the company bridge to get closer to that reality using current resources? Bridging gaps and optimizing existing resources before considering upgrades is essential.

Supplier Development: External Exploration for Growth

On the external front, supplier development focuses on discovering and qualifying new suppliers. The process includes using search engines, responding to sales outreach, and collaboration between engineering and procurement teams. Early involvement of the procurement team in co-developed designs helps in avoiding cost-related challenges down the line.

Qualifying suppliers for bidding involves diverse criteria such as ISO:9001 certification or financial assessments through reports like Dun and Bradstreet (D&B). Establishing qualification criteria up front streamlines supplier selection, preventing challenges in the later stages. The key to supplier qualifications for a company is to determine ahead of time how a supplier will qualify to provide goods or services. Is the primary consideration financial? Physical? Will they need a facility inspection? Is there an alternate supplier if this one is found to be unsuitable? Procurement’s role here extends to managing supplier relationships efficiently, considering the impact on both time and costs.

Business Planning: Catapulting Success

Transitioning to the business planning section, this link forms the foundation for demand and supply planning cycle steps, propelling the supply chain into action.

Category Management: Balancing Local and Global Dynamics

The ongoing debate between sourcing based on location/department or by category/commodity finds resolution in a hybrid approach. While local buyers cater to specific areas for optimal customer service, category managers focus on leveraging the company’s overall market weight for the best value. Identifying top spend categories and managing supplier relationships efficiently ensures value optimization.

Understanding how much spend each category manager oversees and the number of suppliers they handle helps maintain an appropriately sized and efficient team. There isn’t a perfect amount of spend to manage as it varies widely based on industry and size of company, but if a company really wants to know the benchmarks there are businesses like CAPS research who can help (https://www.capsresearch.org/). Alongside this is how many suppliers each category manager works with, understanding that the pareto rule says 80% of a category manager’s effort will go to 20% of their suppliers. If 20% of their suppliers are too few or too many, adjust staffing or workloads accordingly.

Determining the percentage of spend under procurement control involves considering every external expense and enables strategic decision-making. It is common for HR to manage expenses such as benefits or retirement account services, and for legal to manage external legal counsel services. But with a good scope of work and a good relationship with procurement, the supply chain can manage and add value to all of these expenses. When tallying what percentage of spend is under procurement management, include everything that goes out the door: purchase orders, checks, and credit cards included. Then make a decision about what is reasonable for procurement to help manage and add value to based on staffing levels and the expertise within the procurement team.

Market Planning: Maximizing Value through Strategic Insight

Externally, market planning harnesses market information to maximize value. A skilled category manager strategically bids in the market, avoiding the pitfalls of waiting until suppliers perform poorly. This is an art, a craft, and a science all rolled up into one. Bidding when the category market is weak and suppliers are hungrier for the business adds more opportunity for favorable risk terms and pricing. As with all bids, the key to success is a strong scope of work that clearly communicates company expectations and reduces uncertainty. Going to bid in a measured way also allows a company to award most of the work to a primary supplier and some work to a secondary supplier. This proactive approach allows for favorable risk terms, pricing, and the opportunity to maintain relationships with primary and secondary suppliers.

In conclusion, the next article in our series will delve into the demand and supply planning components, offering insights into significant opportunities for companies seeking to advance their supply chain maturity.