Inevitably when you write a book, there are pieces you find you left out. It’s like DaVinci said – “Art is never finished, only abandoned.” Only in this case, a book is never finished, but at some point your publisher says, “It’s done now, leave it!” So as we get down to the final stretch before my book releases, let’s talk about when your organization is ready for e-auctions. That transition happens somewhere between running a small-town corner chocolate shop and running Nestlé, but where is that inflection point? First off, it’s not about the size of your business or how much revenue you have. Let’s talk about what does determine if you’re ready.

Supply Chain Maturity

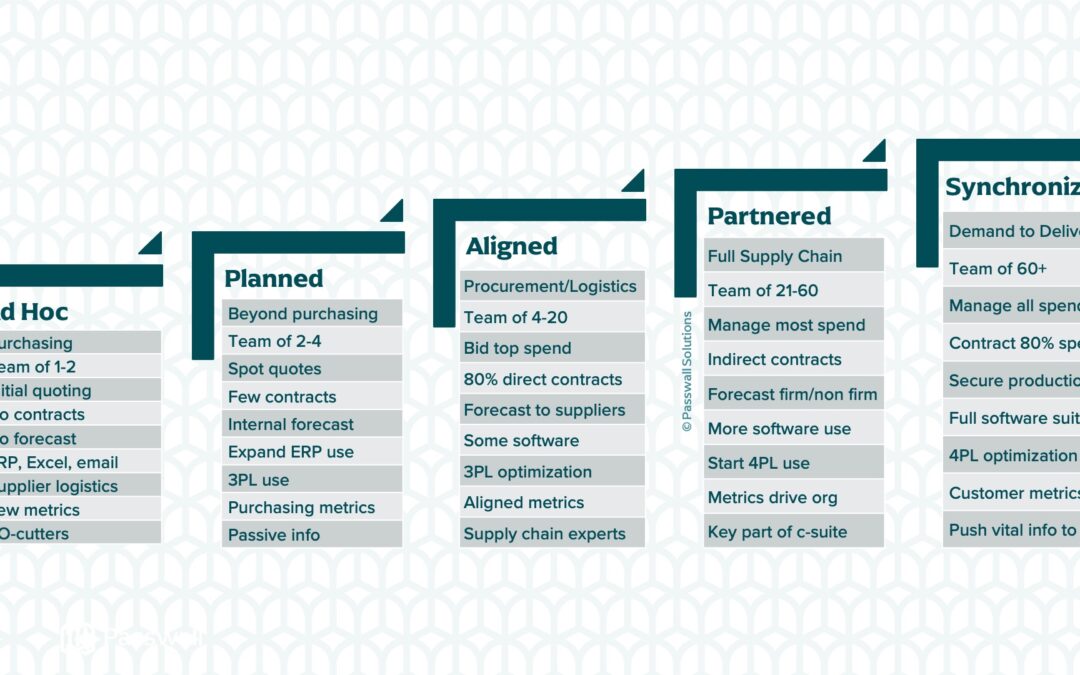

Especially in certain circles (mostly full of supply chain geeks), a lot of people talk about supply chain maturity. From what I’ve seen running Supply Chain 360 Assessments and during my years in the supply chain, these are the major phases of supply chain maturity:

Phase 1 – Ad Hoc – In this phase, the supply chain team is probably called “Purchasing” and that is where they focus.

- One or two buyers are placing purchase orders (POs) for direct materials only, following up on expedites, and calling suppliers after deliveries arrive late, which happens frequently.

- The purchasing team is very good at placing POs and spends most of their time chasing late deliveries.

- The sales team or engineering team probably do most of the quoting and only quote for an initial purchase. An item might be re-quoted when a supplier sends a price increase, but is otherwise ignored.

- There are no contracts beyond purchase order terms and conditions.

- There is no purchasing forecast.

- The only software in use is the Enterprise Resource Planning (ERP) system or Excel and email.

- Suppliers run inbound logistics and are in full control of incoming shipments.

- The purchasing team might track a few metrics such as on-time delivery, but they may not know how those metrics tie into the organization’s goals.

- The larger organization knows to go to purchasing for a PO, but doesn’t consult with them beyond that.

Phase 2 – Planned – In this phase, the supply chain team is starting to branch beyond simply cutting and chasing POs.

- Two or three buyers, or maybe a supply chain manager and a couple buyers are cutting POs, running late delivery reports, and bidding a few items.

- The team is spot quoting a few key items beyond the initial bidding, but the sales or engineering team is still often quoting items for first purchase.

- There are a couple of contracts with suppliers who asked for them, likely using the supplier’s contract template (“supplier paper”).

- There is a forecast for what will be needed, but it is probably short term (6 months or so) and is only used internally unless suppliers ask for it.

- The team is expanding use of the ERP and uses most of its supply chain modules, which may include forecasting, part numbers, material resource planning (if applicable) and running requests for quote (RFQs).

- Inbound logistics is starting to use a third-party logistics (3PL) firm, or potentially multiple freight carriers managed by either a 3PL or someone in the company.

- Purchasing metrics are tracked and available, probably tracked manually or run as a report out of the ERP periodically. Metrics include things like inventory, on-time delivery, and other supply chain-specific metrics.

- Other departments such as finance and operations push information to the supply chain team, such as demand, scheduling, sales forecasts, and cash availability.

Phase 3 – Aligned – The “supply chain” team is now a full procurement and logistics team, and likely does not have responsibility for the warehouse. They are starting to control and proactively seek value in key areas of the supply chain cycle.

- Four to twenty buyers, analysts, managers, and logistics experts are managing procurement and logistics functions.

- The procurement team manages top spend categories, perhaps the highest spend 4-10 categories depending on the categorization method and team size.

- There are written contracts with about 80% of the direct material spend or the highest risk suppliers.

- A purchasing forecast for at least 6 months is being sent to suppliers and used to drive those relationships.

- There is some procurement software in use, probably forecasting software or a procure-to-pay/e-sourcing platform.

- The third-party logistics partner is optimizing runs, finding backhauls (possibly even outbound logistics for product), and combining partial loads to make full loads.

- Supply chain metrics are aligned to company metrics and take a larger picture into account (impacts to company revenue and budget, cash-to-cash cycle, accounting).

- Company employees come to the supply chain team for help with supply chain items and defer to the team’s topical expertise.

Phase 4 – Partnered – Now we have a full supply chain with procurement, logistics, and warehousing. There may still be a few holes in the supply chain cycle, but it’s mostly there. Many companies will stop here in their maturity and that is a perfectly fine place to stop for many businesses.

- Twenty to sixty team members cover multiple supply chain areas and include warehouse managers, category managers, buyers, analysts, logistics coordinators, etc. In large companies, this team might actually be quite a bit larger but still have the supply chain at phase 4 maturity.

- The supply chain team manages all direct spend and some indirect spend, there are still a few things managed by the business units such as employee benefits and 401(k) programs, outsourced legal expertise, and financial investment management.

- 80% of the direct spend and some indirect spend is under contract, matching what the supply chain team manages.

- The forecast, which is regularly sent to suppliers, includes some “non-firm” demand farther out, potentially as far as 24 months, and more “firm” demand beyond lead time, perhaps 6 months ahead.

- The supply chain team is using a more complete software suite, perhaps adding transportation management, spend analysis, and similar tools.

- The team is starting to use a 4PL instead of a 3PL and orchestrating all of the supply chain as one unit.

- Supply chain metrics drive organization metrics, with operations and finance leaders especially aware of how supply chain metrics drive their department’s bottom line.

- The supply chain leader is a key member of the c-suite or company leadership team, and the voice from that seat at the table impacts supply chain’s role throughout the organization.

Phase 5 – Synchronized – At this point the full supply chain team is responsible and accountable for anything that flows through the organization, from the moment of demand until it is delivered to its destination.

- At least sixty team members serve all roles in the supply chain, from demand planning and scheduling to sourcing to logistics support and warehouse management. The team is supported by analysts and maybe dedicated IT resources to keep everything flowing well.

- The supply chain manages all direct and indirect categories, including HR and IT purchases, in partnership with their stakeholders. There are controls to find and investigate maverick spend that doesn’t flow through the supply chain team.

- Approximately 80% of all spend is under contract, with only low risk and low spend suppliers without contracts.

- A forecast secures production capacity with suppliers, helping with their scheduling and ensuring supply in times of scarcity.

- The supply chain team uses a full software suite, which is integrated into the ERP system at every stage.

- The logistics team uses a 4PL and constantly optimizes inbound and outbound logistics and warehouses for maximum efficiency.

- Supply chain metrics are part of the lifeblood of the company and are aligned directly to customer metrics.

- The supply chain team pushes vital information to the rest of the organization and is a trusted partner to other departments. The supply chain is a key resource for market trends, commodity trends, strategy, and company direction.

Why would a company want to increase its supply chain maturity instead of just staying in the “Ad Hoc” phase? First, some of this will happen naturally as a company gets larger and more sophisticated in its needs. Second, as a company hires supply chain professionals into the organization, they will bring their experience with more mature supply chains with them and will be able to see how the company could run better. But the biggest reason to mature a supply chain is value. Highly mature supply chains find, build, and capture value all along the way. They reduce costs. They decrease risks. They improve cash flow. They increase quality. Phase 3 or 4 is a good stopping point for some organizations, but the value is fairly minimal at Phase 1 and 2.

Back to the original question: When is a supply chain ready to add e-auctions to the toolbox? Most supply chains need to be in at least phase 3 (Aligned) or phase 4 (Partnered) to bring in e-auctions. This is because a team at this level of maturity is:

- Ready to get the necessary executive buy-in (the first step!)

- Large enough to support an e-auction program

- Managing enough spend to reach critical mass for bidding and negotiating frequently

- Building strong partnerships and relationships with suppliers

- Running software required for e-auctions

- Using metrics to show success and drive improvement

- Trusted to understand and manage the supply chain function within the rest of the organization

These factors, more than size, are what determines supply chain readiness for the next step of maturity and value. Most of my clients are in the Ad Hoc and Planned phases, just beginning to show their organizations how much value a mature supply chain brings. A couple of my clients are in Phase 3 and 4, and are really rocking and rolling as they bring in new tools to reduce costs and add value.

It’s worth noting that for each dimension, an organization can be anywhere on the maturity model. For example, you may have some software use (Phase 3) but only be doing spot quotes without category management (Phase 2). That’s ok, and it will help you figure out where to focus to move your supply chain forward.

If you’d like to talk about how you get to the next step of supply chain maturity (regardless of where you are), let’s chat. If you’d like to get these articles weekly straight to your inbox and never miss one, sign up for my newsletter.

My book, Transform Procurement: The Value of E-auctions is available for e-book preorder as of May 13th and in paperback May 20th: https://www.amazon.com/dp/B0F79T6F25