I try to stay off of bandwagons. But (you knew that “but” was coming, didn’t you?) I was at a client’s site this week reviewing category strategies, and of course the subject of trade tariffs came up. Then on a call with a different client this week, someone brought up their use of “tariff forms” as a method to combat increasing supplier prices due to tariffs. This is not surprising because category managers everywhere are currently trying to figure out: which products do tariffs affect? How much? And most importantly, what can I do about it? This article covers some more short-term strategies on dealing with tariffs, without going into reshoring, onshoring, nearshoring, etc.

What is Affected?

The first step is simply to figure out what materials are affected by tariffs. It’s likely your procurement team has already started this, but if not, it’s time to do so. Start with your most likely materials, such as those made out of steel and aluminum. Then, you may have to ask your suppliers where they are manufacturing materials if you do not already have this information. It’s very difficult information to get any other way. Note that your own customers might be also asking these questions, so when you’re gathering the answers, share them with your sales team.

Throughout this process, including the initial information gathering, the procurement team has to form a metaphorical “shield wall” and approach tariffs as a unified front. If category managers or other team members step out in front and move forward before the team is ready, it forms a weakness in the procurement strategy. The team has to move together cohesively, especially if multiple procurement personnel work with the same supplier(s).

How Much Does the Tariff Impact?

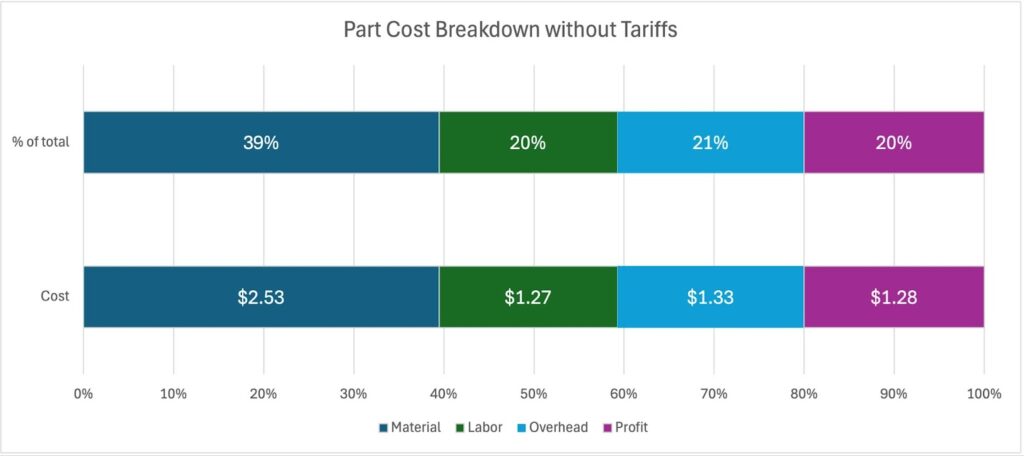

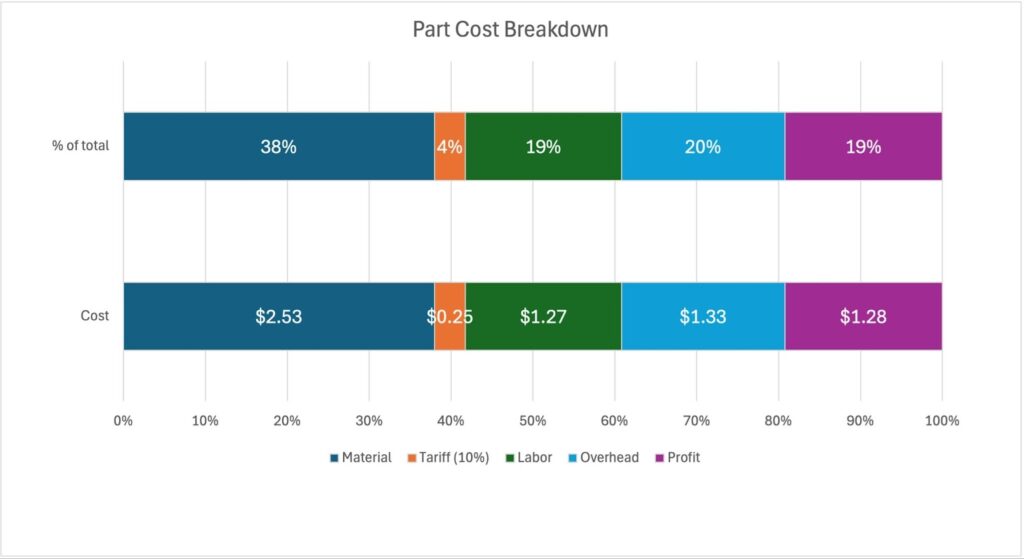

Once you have identified the materials and suppliers impacted by potential tariffs, the next step is to figure out how the tariff impacts the final price of the material. This means figuring out the cost breakdown of the material, including labor, overhead, and supplier profit. If a product is manufactured in the US using materials sourced from overseas, the tariff only applies to the materials imported. It does not apply to domestic labor, overhead, or profits. Two charts illustrating this are shown below, using a 10% tariff as an example:

It will seem easy for suppliers to take a 10% tariff and translate it to a 10% price increase. However, even if that item is fully sourced from overseas and subject to tariff, profit and any freight fees are still unaffected by tariff. Push suppliers to only apply the tariff to the relevant component of the imported goods. If you already have index-linked pricing from suppliers, you should have the percentage of the purchase price that comes from materials. Note in the example given that when materials are about 40% of the purchase price, then a 10% tariff translates to a 4% price increase when passed through.

Short-term Solutions

One option for a short-term tariff solution is to implement some sort of tariff form. Similar to my post about good bureaucracy, this is a situation where the tariff form intentionally makes tariff price increases difficult. A tariff form requires suppliers to provide receipts from their suppliers, showing the actual tariffs applied at the border. Once you know the actual amount of tariff paid, make any pricing changes take effect as a surcharge so it is easier to change later.

If you work with distributors, ensure they do not apply their markup to the tariff. Just as with the exercise with the cost breakdown, keep the tariff as a surcharge and only allow distributors to apply it to the base cost. Good distributors will help you fight tariffs using cost breakdowns and their purchasing power, so keep those relationships strong. Consider going with your distributors to the negotiating table as they work with their own suppliers to minimize the impact of tariffs. With a cohesive short-term strategy, forming a shield wall with your fellow procurement team members, working with your suppliers, and keeping tariffs as a separate surcharge, you can ensure tariffs reflect their true impact to your supply chain. Without short-term safeguards, it’s easy for tariffs to suddenly compound with every step. Once your short-term strategies are in place, you can start thinking about if and how you will modify your supply chain for the long term. If you would like to talk about your tariff strategy, let’s chat.