The last time I searched for an image depicting negotiation, all I found were variations of two shaking hands – unmistakably two white men in suits. This time, as you can see, there were more diverse options. In today’s business landscape, negotiations rarely play out as two people, regardless of gender, age, or attire, simply shaking hands. The crux of negotiation has always been information, irrespective of the setting, time frame, or formality. This article delves into various negotiation methods tailored for procurement professionals, with a spotlight on those grounded in data.

Market Research

Before diving into any negotiation, it’s essential to grasp the market dynamics related to your purchase. For negotiations driven by commodity prices (steel, lumber, copper, rubber, and even labor rates), understanding market trends is paramount. My go-to resource for commodity trends is the Bureau of Labor Statistics producer price index page. I prefer this source because it’s free, offers extensive historical data, and is as unbiased as data can be. I typically start by entering a couple of keywords in the “Products” search field on the right and then use the information to fill in the “Industry” on the left. This approach proves useful for everything from consulting rate trends to various steel pricing and livestock costs. The downside is that this data is often a month old and doesn’t specify current rates, only tracking pricing trends over time. Armed with this data, procurement professionals can assess whether bids align with market trends and structure supplier contracts based on this information.

Cost Breakdown

The cost breakdown method hinges on a substantial level of trust between the company and the supplier. Here, the supplier provides a detailed breakdown of their costs, allowing the company to identify potential areas for cost optimization. While this is a data-driven approach, its effectiveness relies heavily on the supplier’s willingness to be transparent. Though it can effectively reduce costs, it demands a high level of collaboration between the company and the supplier.

Should-Cost Analysis

This negotiation method involves the company understanding the typical market price for a good or service and steering the target supplier toward that price. While straightforward for readily available products, it becomes challenging for specialty suppliers or markets. A variation of this method involves leveraging knowledge about competitors’ costs to compel current suppliers to match those prices. This approach fosters mutual benefit by providing suppliers with competitive data and helps the company maintain profitability in its markets.

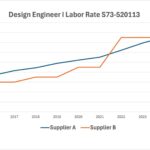

Historical Pricing

A goldmine of data for negotiations lies in the company’s historical data, especially for long-standing key purchases. Analyzing the pricing history in comparison to indices or inflation rates proves invaluable. This strategy also provides a competitive edge as the other negotiating party lacks access to this information unless granted by the company. However, the drawback is that obtaining useful historical pricing data can be costly and time-consuming, considering the inherent imperfections in data quality.

Stay tuned for my next article, where I’ll explore negotiation methods that involve altering negotiation parameters for either individual or mutual gain.