When I started helping businesses with their supply chains, I was surprised to learn how few had written contracts beyond purchase orders or maybe blanket POs. But I get it. Contracts are expensive, they don’t always seem to have value, and they take forever to negotiate. Today’s article is an argument for contracts – why your business needs them and where you can push for value with your suppliers.

Why Contracts

When I worked in procurement for a large utility conglomerate, of course we had written and signed contracts…for everything. Finding a supplier without some sort of contract terms was pretty rare, and usually indicated a vendor and not a supplier. Before that at an equipment manufacturer, procurement didn’t negotiate contract terms but our legal team did. Early in my procurement career, I took it for granted that most businesses negotiated contracts as part of their day-to-day procurement activity. But I’ve learned not all do. Here’s why every business needs at least a few contracts:

- Risk mitigation – Many companies don’t realize how much risk they carry. If you have supply contracts with your customers, they are passing some of their business risk to you (think: requirements to purchase or not purchase excess inventory, long payment terms, on-time delivery guidelines, etc.). But if you don’t have corresponding terms with your suppliers, you are carrying all of your customers’ risk. Have excess inventory the customer cancelled? You can’t return any of it or the materials to make it to your supplier. A contract can at least outline what you can and cannot sell back to your suppliers in case your customer order changes.

- Strengthen relationships – Both the act of negotiating a contract and having written rules will strengthen your ties to a supplier. Going through a contract negotiation indicates to the supplier that they are an important enough part of your business to invest in, and gets rid of some of the daily negotiation/uncertainty of the relationship.

- Clarify and document – A full written contract clarifies the scope of work to be completed, expectations around contract terms, and what does and does not have value for both parties. It gets rid of the “we didn’t know” aspect of doing business, because both parties signed off on what would happen. While there can be situations outside of a contract (especially one that’s too short), most situations should be covered in a basic contract.

- Savings – A well-negotiated contract should save the company between 1 and 3% on the spend in that category. This savings is a combination of risk mitigation (not having to scrap as much excess inventory, suppliers holding higher insurance limits that cover more situations, etc.) and actual savings from price reductions and cost certainty. It’s hard to have an index-linked price without a document describing the process and equation for price changes.

Value and Risk Mitigation

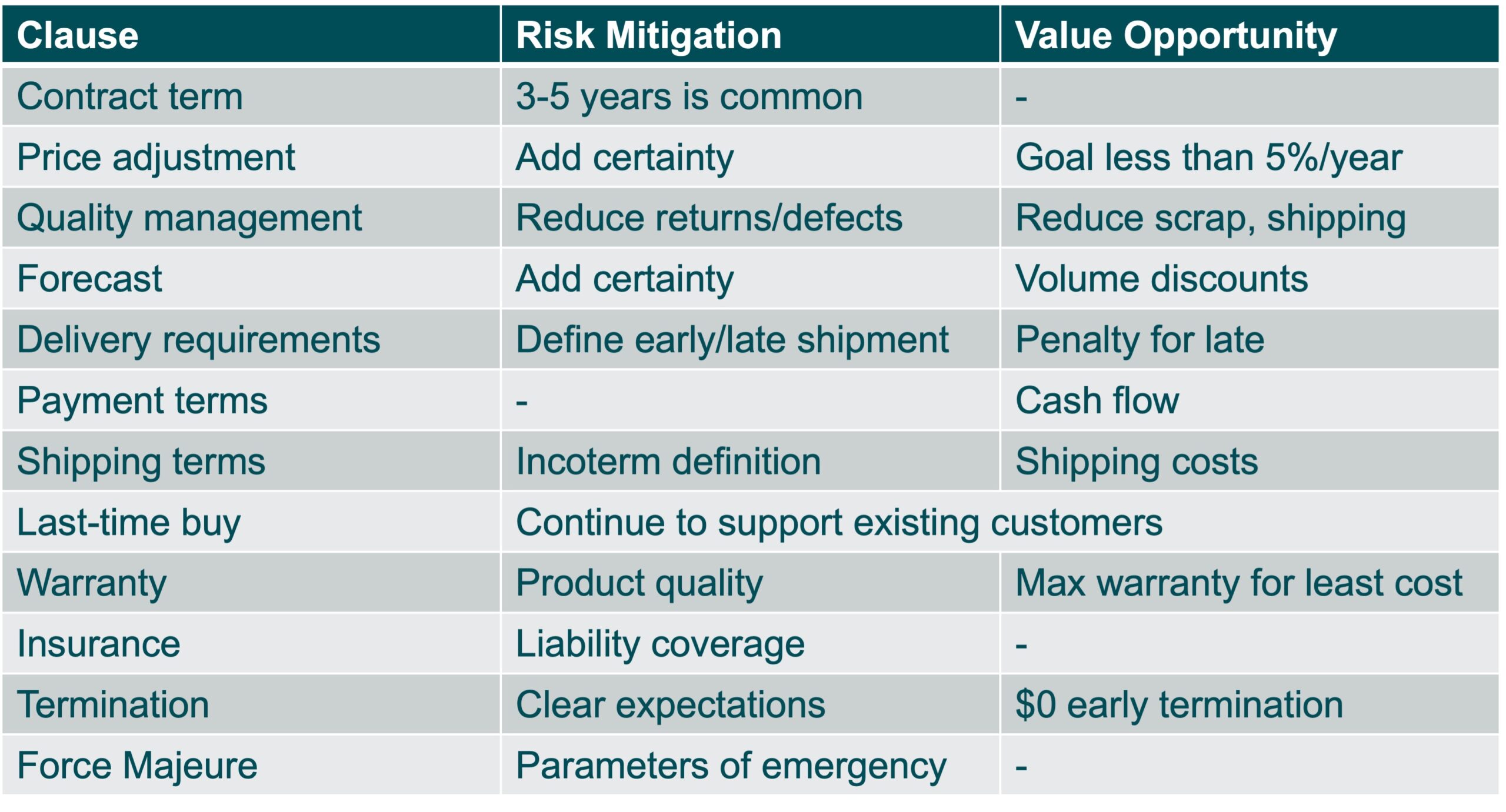

The value and risk mitigation opportunities tend to be specific for each category, but there are things to look for when negotiating a contract in each clause. Here is a breakdown of the clauses, their risk mitigation impacts, and their opportunities for value.

Contract term – a longer contract term is a negotiation tool and can be a way to both add certainty (reducing the risk for both parties) and potentially decrease pricing due to that certainty.

Price adjustment – this clause does just what it says; it dictates when and by how much a supplier can change pricing. Index-linked pricing might belong here, or in an exhibit with more detail.

Quality management – which system the supplier must follow, how defects will be handled, and how defects can be reduced are all part of contract clauses that reduce both risk and cost for both parties.

Forecast – knowing when orders are “firm” or not will help both parties plan ahead and increase efficiency. It may also mean a company can make use of volume discounts by committing to volumes in a forecast without having to actually receive larger shipments.

Delivery requirements – both sides knowing what constitutes an early or late delivery and the penalties for deliveries outside the expected window helps keep the flow of materials and services smooth and efficient.

Payment terms – longer payment terms are a one-time cash flow bonus, but an early payment discount has a lasting savings impact.

Shipping terms – this one is especially important in our current tariff-uncertain world. If you have a contract with “Delivered Duty-paid” Incoterms, it technically means a supplier pays ALL tariffs included in the terms of the contract. While many supply chain professionals are still negotiating these tariffs even with a DDP contract, it is actually enforceable that tariffs are included in the price. That being said, most suppliers will simply choose to not perform to the contract and trigger contract termination if forced to cover large tariff costs. Contracts still only go so far.

Last-time buy – this clause lets you purchase a large order of a part that will be discontinued so you can continue to support your own customers over time. A last-time buy is especially important for equipment manufacturing or complicated assemblies being sold directly to consumers with longer warranty periods.

Warranty – warranties are only as good as the operations and warehouse teams are to enforce them, but they can have huge value.

Story Time! A few years ago, many utilities replaced street lights with LED lights. They were more energy efficient, were supposed to last longer, and made a brighter light. However, many of them started turning purple a couple years after installation. And I don’t mean a little purple. I mean brilliant, violet purple. Some of the utilities had negotiated good warranties with the manufacturer and their distributors, who then worked together to replace the faulty streetlights. Other utilities without a strong warranty clause had to cover the cost to replace these lights, which was expensive and is why you still occasionally see purple lights in some areas. (Still report a purple street light if you see one to the local utility so they can work on replacing it). This story is a good example of why it can be important to have good warranties, especially for key categories.

Insurance – requiring a certain level of insurance coverage protects both parties in a contract. Insurance is especially important if there is a limitation of liability clause in the same contract (more on limitation of liability clauses here). Insurance inherently reduces risk.

Termination – it helps both parties to know when a contract terminates and what they could do that would trigger a termination. As a buying company, watch out for early termination fees.

Force Majeure – this clause covers what happens in an emergency. In an increasingly volatile weather climate, force majeure situations are more and more common. How will they be handled? When is something force majeure and when is it simply the normal course of business? The World Health Organization considered COVID-19 a global pandemic for three years. Does a supplier get to declare force majeure for all three of those years? Especially with the supply chain disruptions of that time, it’s important to know.

Hopefully you’re now thinking about all those suppliers you should have contracts with, but somehow don’t yet. If you’d like to talk through contract negotiation or get some help doing so, let’s chat. If you’d like to get these articles weekly straight to your inbox and never miss one, sign up for my newsletter.

My book, Transform Procurement: The Value of E-auctions is now available in ebook, paperback and even hardcover format: https://www.amazon.com/dp/B0F79T6F25